Behavioral Investing

The psychological approach to investing

In this book, psychologist and asset manager Daniel Crosby examines the entire spectrum of sociological, neurological, and psychological factors that influence our investment decisions, providing practical strategies to enhance returns and improve market performance. Readers are...

offered the most comprehensive analysis of behavioral aspects to date, along with specific recommendations on decision-making processes and overcoming the fatal flaws that most investors suffer from.

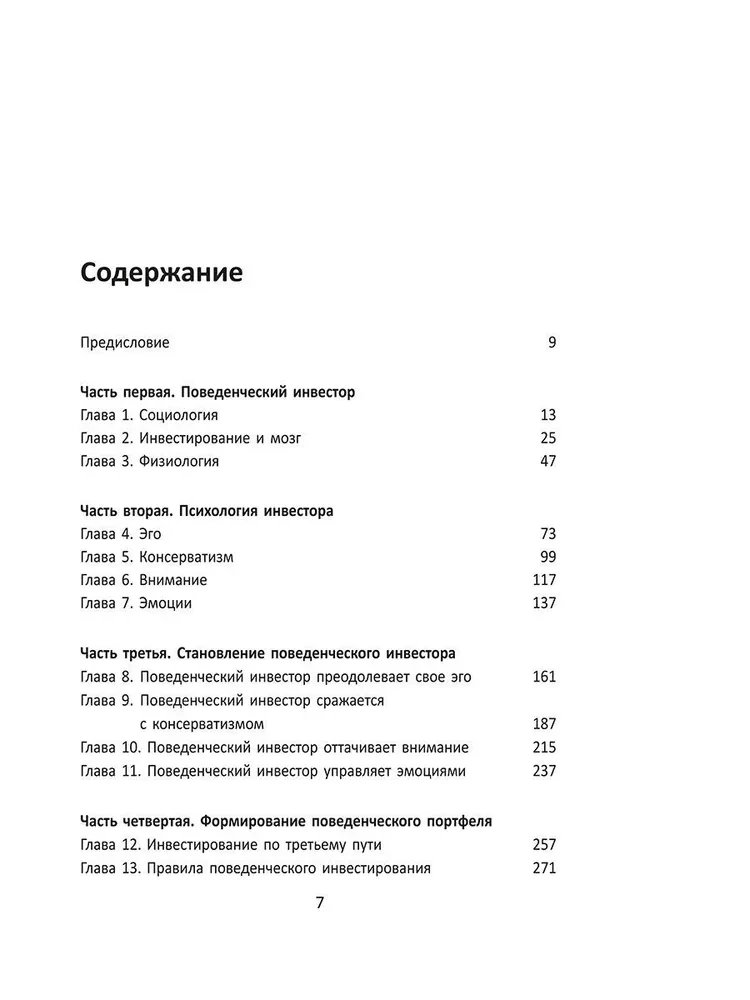

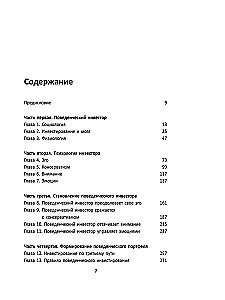

The book consists of four parts:

1. An explanation of the sociological, neurological, and physiological factors that hinder rational investment decisions. Readers will gain a better understanding of how external conditions subtly affect our choices.

2. A discussion of the four main psychological tendencies that influence investment behavior. Readers will be able to analyze their own behavior, rid themselves of excessive self-confidence, and learn mechanisms that allow for an objective assessment of their decisions.

3. Practical implementation of the principles discussed in the first and second parts.

4. An introduction to the "third way" of investing, based on reality and considering contextual and behavioral shortcomings. Readers will gain a better understanding of the psychological underpinnings of popular investment strategies, such as value and momentum investing, and understand why all forms of successful investing are based on psychological factors.

Wealth is essentially a reflection of both financial and psychological well-being. The aim of this book is not only to enrich the reader in the literal sense but also to provide them with tools to increase their wealth and knowledge.

Author: Дэниел Кросби

Printhouse: Popurri

Series: Personal Finance

Age restrictions: 16+

Year of publication: 2023

ISBN: 9789851553132

Number of pages: 352

Size: 207х145х20 mm

Cover type: hard

Weight: 405 g

ID: 1332213

-medium.webp)