IPO and SPO. Structuring, Pricing

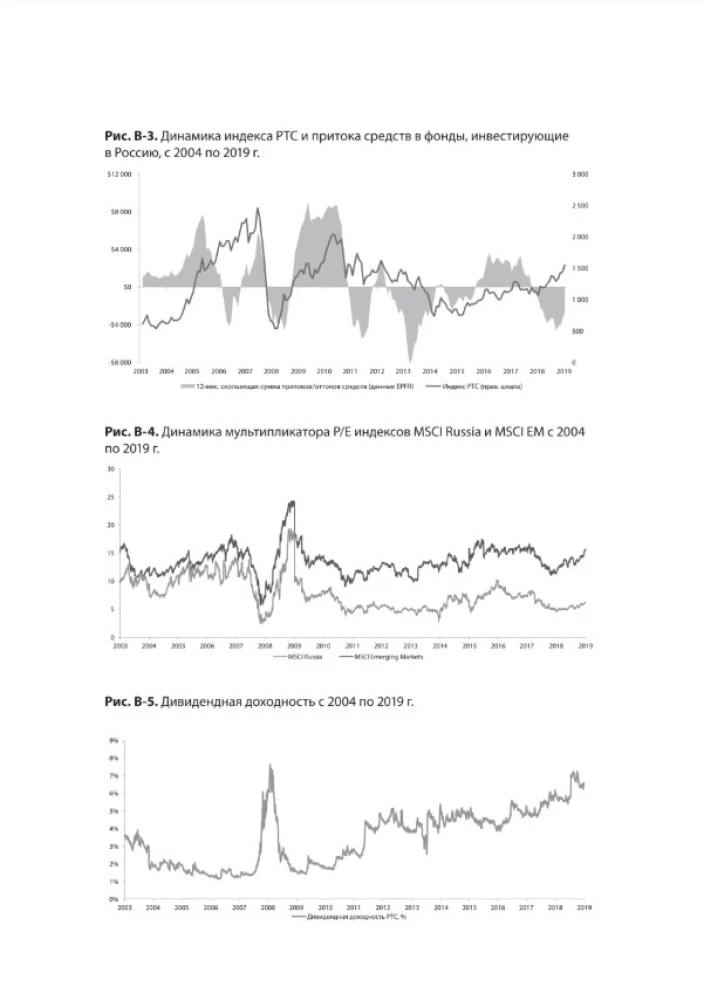

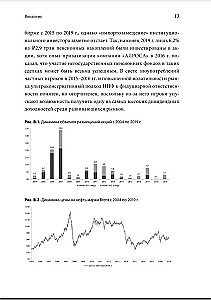

Objective answers to the most important questions arising during placement in the Russian market of equity capital. Russian stocks are traded at a discount to their counterparts in emerging markets, even despite the increase in the dividend flow paid to...

minority shareholders. This is largely due to vulnerability to global trends, as well as the risks of Russian corporate governance. If you are a consultant or, even more so, the owner or manager of a company planning to place shares on the equity market, the following questions are relevant to you:

— How to choose a platform for placement?

— How to determine the target offering volume?

— At what level to set the price?

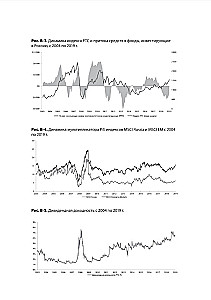

— What price dynamics is considered normal?

The author compellingly shows that Russian companies and Russian shareholders tend to have an aggressive approach to pricing. This phenomenon is traced through primary placements, and he sees the solution to this problem in the area of pricing. In recent years, the percentage of market participants in placements demonstrating a more balanced approach to pricing has increased, which, along with the rapid recovery of the market after the events of 2014 and 2018 and the prerequisites for reducing dependence on foreign investors, helps to look to the future with optimism.

This is a revised edition of a book that was previously published under the titles “Placement of Shares” and “Placement of Shares: Structuring and Pricing.”

Author: Антон Мальков

Printhouse: Mann, Ivanov i Ferber

Age restrictions: 16+

Year of publication: 2020

ISBN: 9785001691914

Number of pages: 192

Size: 240x166x18 mm

Cover type: hard

Weight: 460 g

ID: 1341795

from € 38.94